Our forecasting algorithm beat official accrual adjustments by 45 percent

The budgeting team at a large international asset management firm was dissatisfied with the accuracy of their fund expense forecasting.

Excel models retained the same simplistic calculations even as more data became available to refine them.

Updates from expense owners in relevant departments (e.g., Legal) were not collected and incorporated into the models.

Sizeable accrual adjustments were required at year-end due to under-forecasting and under-accruals.

OnCorps built an AI-powered system that analyzed five years of historic expense, invoice, and accrual data. Using this data, along with AUM data, our data science team implemented a machine learning model that learns to improve forecasting accuracy by fund and expense type.

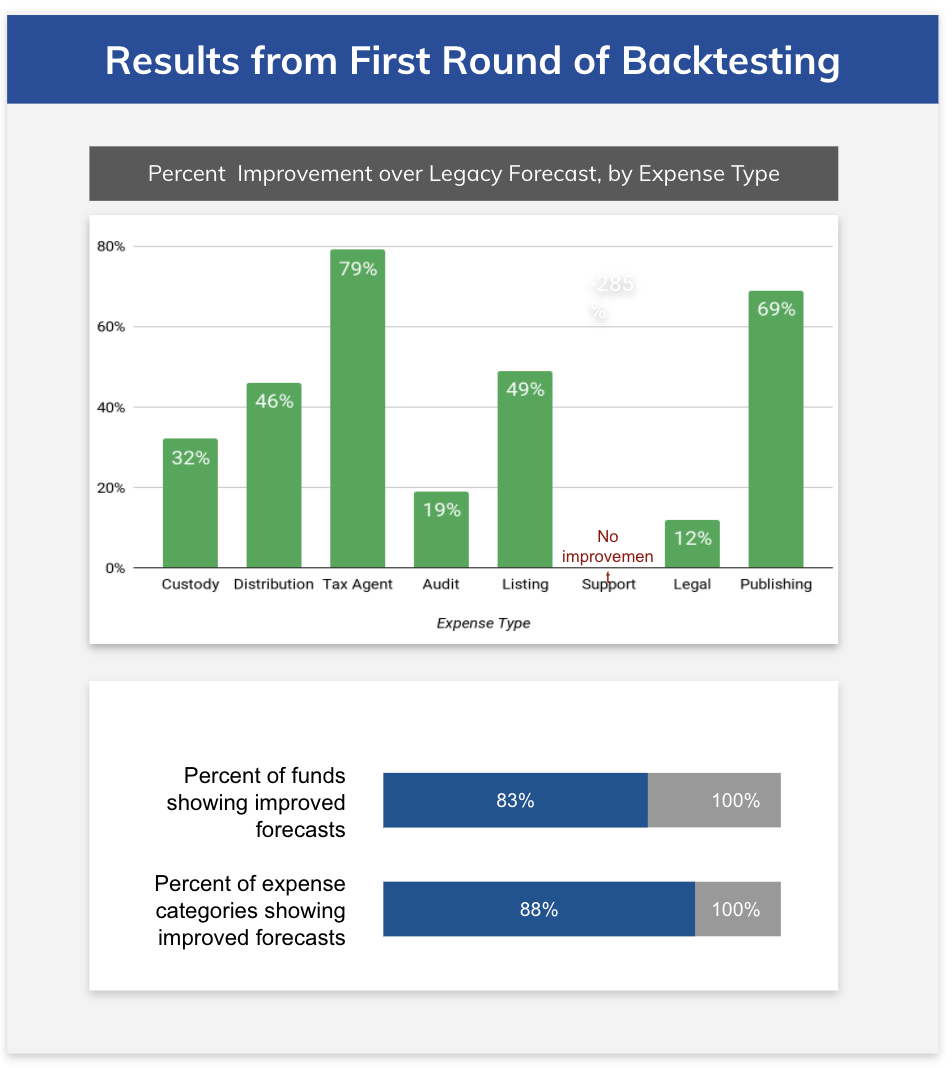

Our trained models were run against both the legacy forecast and actuals for the prior year. Six months out from year-end, the OnCorps forecast beat the legacy forecast for 25 out of 30 funds. Three months out, OnCorps was more accurate for 29 of 30 funds. Improved AI forecasting will allow the firm to change controllable expenses sooner and improve profitability.

"OnCorps' algorithms analyzed over 13,000 models in order to select an optimal model for each fund and expense type combination."

If you'd like to learn more about OnCorps' Forecasting solutions, please complete our contact form or email us at inquiries@oncorps.ai